Billing

This topic provides an overview of Ververica Cloud billing. It introduces the terminology, describes how Ververica charges for resources, and uses examples to explain how line items on invoices are generated.

Ververica understands the significance of data security, especially when it pertains to confidential financial information. Ververica never stores sensitive payment details or invoices on our servers. Instead, all such information is handled by Stripe, which adheres to the highest industry standards of data protection and security.

Overview

The following points outline the principles behind Vererica's billing and invoicing:

-

Billing applies at the user account level.

-

Only a workspace owner can specify the payment method (credit card details) for a workspace, and provide billing information. See Manage your payment method and Manage your billing information.

noteBilling information is necessary for invoicing, and is associated with the User account, not with the payment method, or individual workspaces. It can include name, business name, address, email, telephone number and tax ID. Not all items are mandatory, and some can be different from those specified in the payment method. For example, the address to which invoices are sent might not be the same as that of the payment credit card.

-

Users are billed by the hour for all the workspaces they own, and charged at the end of the current billing period (the interval of time between billing statements; normally one month). There is only one active billing period for a user at any given point in time.

-

All workspace costs are accounted for on an invoice, and are grouped by cloud region and offerings, as described in Example invoices.

-

Depending on the workspace region and offering type, invoice line items can include costs for Compute Units (CUs) or Network Transfer Units (NTUs). See Resource costs.

-

Any credit remaining from a Start for Free workspace is deducted from the PAYG subtotal to give the final invoice amount.

-

If a user deletes all their workspaces, any outstanding charges are invoiced at the end of current billing period. If the user subsequently creates another workspace, a new billing period commences at the start of the next month.

-

If, after deleting all their workspaces, a user deletes their account, any outstanding charges are invoiced at the end of current billing period.

What invoices will I receive?

Ververica does not charge for any additional AWS services, nor do we show them on our invoices. You will normally receive two bills:

- Ververica invoice: All prices for AWS services fully managed by Ververica cloud are included in the base price of Network Transfer Units (NTUs) and Compute Units (CUs). See Resource costs.

- AWS invoice: Separate from your Ververica Cloud invoices, you will receive invoices from Amazon for services that are part of your own AWS cloud account.

The two types of invoice are not consolidated.

Offerings and offering types

Ververica currently has two offering types: Pay as you go (PAYG) and Reserved capacity (RC). These are introduced in Offering types. Briefly:

- The RC offering type has a set of predefined offerings. These are specific instances of the offering type, e.g. RC20, RC30, RC50 (where 20, for example, refers to a limit of 20 CUs per workspace); Ververica also supports custom RC offerings. This allows you to order different offerings per cloud provider, at the workspace level.

- The PAYG offering type only has one offering (PAYG).

For the latest offering types, see this page.

Resource costs

Ververica Cloud offers Pay As You Go (PAYG) and Reserved Capacity (RC) workspaces. The resource costs vary by workspace type.

Resource costs are based on Compute Units (CUs) and Network Transfer Units (NTUs).

- 1 CU = 1 CPU core / 4 GiB

- 1 NTU = 1 GB network traffic

For the latest pricing, see this page.

Example invoices

It's easiest to explain how billing/invoicing works by way of a couple of examples.

The examples in this section are for illustrative purposes, and may not reflect latest offering types, offerings, or pricing. See this page for up-to-date information.

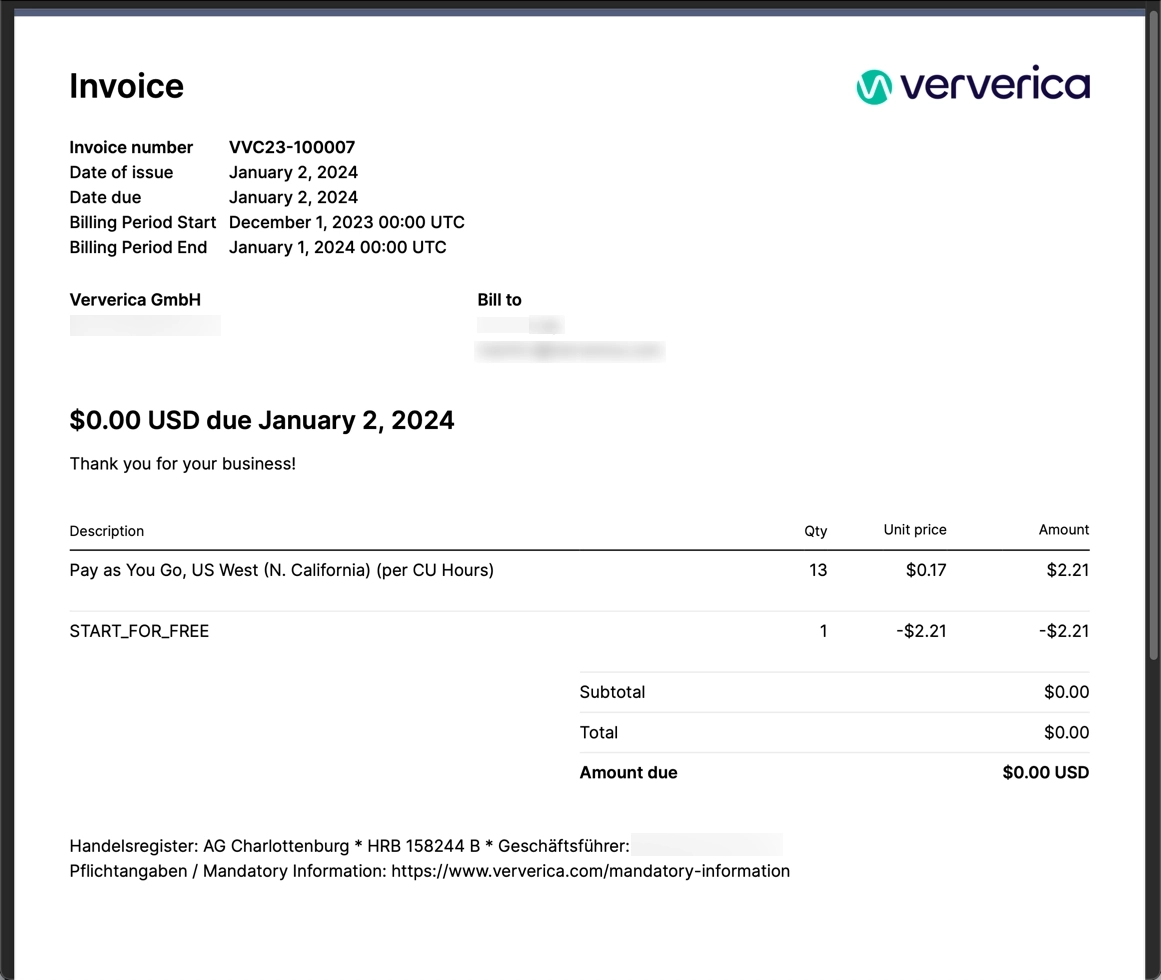

Example 1: Single PAYG workspace

In this example:

- No billing information (specifically, tax ID) has been supplied by the user, so there is no tax ID/rate shown on the invoice. See Manage billing information.

- Only CU resources have been used, so there are no entries for NTUs on the invoice.

- This is the first PAYG workspace created by this user; it uses some of the available free credit.

The above image shows:

- The unit price for CUs for a PAYG workspace in the US West region is $0.17

- 13 CUs have been used and charged for in this billing period.

- Since the cost of resources is offset by some available free credit, the net amount due in this case is zero.

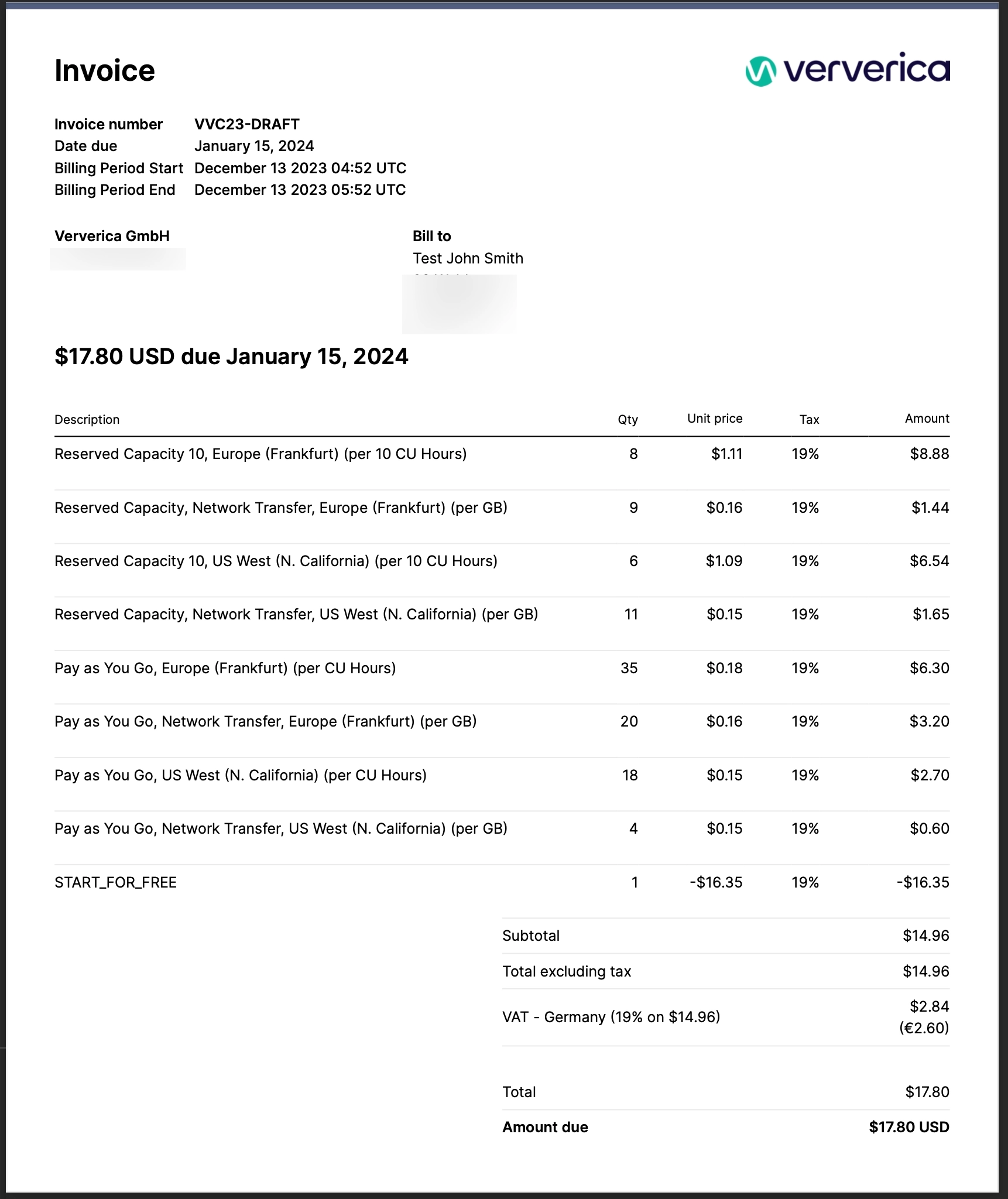

Example 2: Multiple workspaces

In this example:

- The user has several active workspaces.

- The workspaces use different offering types (RC and PAYG) and offerings (e.g. RC20, RC30, PAYG), in different AWS regions (e.g. US West, Europe).

- The user has entered their billing details, including tax information.

- The invoice contains line items for both CU hours and NTU usage.

- The user created a Free to Start PAYG workspace, so some credit has been applied.

The image below shows an invoice for this user.

In the above image, different resources are grouped as separate invoice line items, as follows:

It is important to note the difference between offering type (e.g. RC or PAYG) and offering (e.g. RC20, RC30, RC50, PAYG). Currently, Ververica only provides one PAYG offering type (so in this instance, offering and offering type have the same name: PAYG).

- CU billing items are grouped by offering (e.g. RC20, or PAYG) and region (e.g. US West). A separate invoice line is generated for each unique grouping, giving aggregate costs for that grouping.

- NTU billing items are grouped by offering type (e.g. RC, or PAYG) and region (e.g. US West). A separate invoice line is generated for each unique grouping, giving aggregate costs for that grouping.

- Applicable tax liabilities are explicitly shown for each line item. See Manage billing information for details.

- Any Start for Free credit used is shown as the last line item, and is deducted from the PAYG subtotal.

What next?

See the following topics for instructions on managing bills and invoices:

- Manage your payment method (for providing credit card details)

- Manage your billing information (contact/address details for invoices, and tax ID)

- Check past invoices

- View bill summary data

- View usage

- View cost estimates

- What happens if my Start for Free account expires?